In order for myself to be successful blogger, I have to write. Since the written word is my chosen form of communication, there is nothing more important in my day than the act of writing.

I therefore arrange my schedule around time for writing. The least important tasks like checking email, non-urgent callbacks, marketing, accounting etc… will have to work its way around my writing schedule.

The concept of making time for what’s most important is something that can help improve all areas of life, especially financial. Instead of prioritizing bills like credit cards, cable bills, and so on, you can prioritize your financial goals. This concept is known in personal finance as, “paying yourself first.”

Paying Yourself First

Paying yourself first is the habit of saving a portion of every dollar earned before paying any other bill. It’s arguably, the most important financial habit for growing wealth.

Instead of deciding how much to save at the end of the month from what’s leftover, you commit at the start of the month on how much to save. Each time you fail, you’re telling yourself that, “my _____ (insert random bill) bill is more important than _____ (insert a goal).”

How To Start Paying Yourself First

From Phase 3 of your personal financial plan, you have a list of financial goals. The purpose of this step was to make sure you’re saving money on things you value most. At the same time, becoming aware of all things you spend money on that you don’t value.

If your goals are not worth getting out of bed for in the morning, now is the time to revise. What’s the purpose of going to work each day if you don’t even enjoy the rewards received?

You can have as many or as little goals as you like. As an example, here are some of my goals:

- Giving

- Travel

- Home Renovations

- Car

- Early Retirement

At the start of each month, I decide on a percentage of income that will go towards each goal. Since I have irregular income, I choose to use a percentage. However, if your income is consistent, you can set aside a specific amount each month.

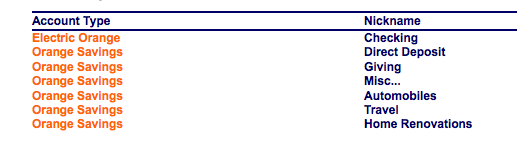

I set up a new savings account for each goal. Here is a screen shot of what my actual bank account with ING Direct looks like.

*The part that goes towards early retirement gets invested into a Total Stock Market Mutual Fund outside of my bank.

At the end of the month, once my income is known, I transfer money from my direct deposit to a different savings account. I do this before paying any other bill I have.

In the few years I have paid myself first, I have yet to miss a payment to myself. Twice, thanks to a few wedding expenses, I was unable to pay off other miscellaneous bills. Missing a payment on one bill for one month wasn’t the end of the world. All that happened was I had to pay a few late charges, which were just a few dollars, to my cable and gas bills the following month.

Tips To Paying Yourself First

Like any new habit, paying yourself first will take some time to get started. Here are ways that can help you develop one of the most important financial habits:

- Start Small – You can start saving towards a goal with as little as 1% of your income a month. Followed by, gradually increasing your allocation by 1% a month until you reach your target.

- Hide Your Raises or Overtime – If you have more money in your paycheck than before, pretend that raise never happened. Continue to live off of what you’re used to living off, and save the extra.

- Save For Worthwhile Goals – If these goals don’t make you want to get out of bed each morning and give your best, revise them.

- Hide Extra Paychecks – If you’re on a monthly budget and get paid every other week, there are two months out of the year in which you will have 3 paychecks. Practice living off of just 2 paychecks, and save the entire third.

- Automate – Take advantage of using direct deposit at your job. If your income is consistent, set up automatic monthly withdrawals from your direct deposit towards your goals.

Moving Forward

Personal finance is fairly simple once you establish this habit. Using the fundamentals you learned from each phase of the personal financial plan series, you can do anything you ever wanted.

This concluded the series on developing a personal financial plan. On Wednesday, I will be posting a video reviewing the 5 Phases. Also, I plan to write a more detailed free e-Book about this series. Please sign up for the newsletter if you’re interested in receiving this free e-Book.

Comments on this entry are closed.