This post is pretty long, so you might want to just skip through it. If you manage to get to the end, you will be surprised. This post goes against what you typically here about asset allocation and investing.

After a little deep thinking, all I’m doing is sharing with you my opinion. An opinion that I was not educated enough to make until now. Feel free to disagree or agree, but make sure you do so in the comments. ![]()

Why do we Invest? | Human Capital vs. Financial Capital

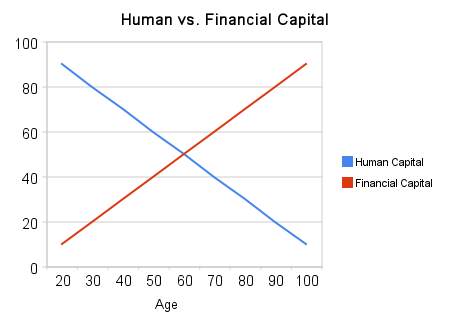

Our wealth is made up of two different components; human capital and financial capital.

Human capital is the value of our remaining working years. The more working years we have left, the greater our future labor is worth.

Unfortunately, human capital diminishes with age. Luckily though, we can turn our human capital into financial capital through investing. Now our income can remain constant, even though our productivity, or human capital, decreases.

Here is a visualization of human capital vs. financial capital throughout one’s life.

The Current State of Investing

As a member of Generation Y, we have a different view of investing than any other generation.

Until 1981, nobody even heard of a 401K or Roth IRA. Our parents instead had what is known as a defined benefit pension plans.

These pension plans were a pretty simple concept. An employer would set aside money, on behalf of the employee, toward a large pool of funds. The funds were commingled together and invested by a large institutional investor.

Once an employee retired, they would receive a guaranteed payment for the rest of their life. Retirement investing was really that simple for our parents. The burden was completely on their employer.

However, around 1980 many businesses were struggling to keep up with their pensions. Pension plans cost a lot of money to maintain, especially when the stock market isn’t doing so well.

In 1981, a guy named Ted Benna changed how everyone from then on saved for retirement.

Mr. Benna found a loophole in the U.S. tax code under section 401(k) that allowed employers to have self-directed 401K accounts for each individual employee. Soon, employers stopped contributing to defined benefit plans and shifted the burden to save to the individual.

It wasn’t that bad for a while. The market started going up. From the years 1981 – 2000, the stock market returned on average 16.63%.

Everyone was happy. Baby boomers were making double-digit returns. The mutual fund companies could charge high fees that nobody noticed. There was actual a great relationship between Wall St. and the individual investor. Imagine that!

Unfortunately, you know how it ends. The bubble bursts in 2000 and all the baby boomers are in shock. Anyone who was throwing darts to select mutual funds for the past 20 years, were caught with their pants down around their ankles. They didn’t know the concept behind asset allocation, diversification, tax-efficiency, etc… All they knew is that they were making a killing and it was because of the geniuses on Wall St.

Why Does This Matter?

We are one of the first generations to realize that the burden of investing is 100% the individual’s responsibility from day one.

More importantly, no generation has completed its life cycle yet with this mindset. There is plenty of research showing how we can maximize our investments over a 40 year period (Think of the typical advice, invest risky while you’re young and decrease risk as you approach retirement age). However, do we really know that this approach to asset allocation is really the best way to go about saving?

Should Human Capital Be Included in the Asset Allocation Equation?

In previous generations, workers entered the work force thinking that they could work for the same company their entire lives. This company was going to pay them for their services for 40 years and then pay for their retirement. If they changed jobs, it was usually inside the same industry.

Now, someone in our generation has to standout to even get a good job. But don’t expect them to stay there that long. Our generation shifts not only jobs but careers.

Not only do we have a different job environment then our parents, we also have student loans, $30,0000 weddings, rising health care costs, and on top of that, we don’t know what the hell we want to do with our lives.

If we classified our situation as an investment most of us would have the risk level of a penny stock or a junk bond. While our parents, when they were our age, were more like a safe bond investment insured through the government.

The reason I bring this up is because modern portfolio theory, which is the research behind most of what we know about asset allocation today, isn’t very modern. The theory originated in 1950 and was worked on through the 70′s. If the risk of our human capital has gone up, shouldn’t the risk of our financial capital decrease?

A Different Approach | Combining Human and Financial Capital into One Portfolio

As I learn more about financial planning, myself, and our generation as a whole, I’m starting to go against what I have read and previously taught about asset allocation.

We should not be taking such a big risk with our financial assets in our 20′s. Of course we’re giving up long-term returns of our financial capital by being more conservative for a few years, but we also give ourselves flexibility. A trait that is very valuable, both monetary and personally, to our human capital and well-being.

By no means does this mean to stop saving. We always need to be saving at least 10%-15% of our income. However, we don’t need to be in such a rush to begin saving in risky assets, like stocks, for our retirement.

When we hit our 30′s, we gain a little more stability in life and therefore can afford to take more risk with our financial capital. For now, there is a lot of uncertainty in our financial situation. Our asset allocations need to reflect that.

Final Thoughts

There is no cookie cutter approach, like a target retirement fund, to this method of financial planning, which is good thing. I can’t give you any baby steps or an automatic millionaire method.

I can tell you that you should probably take a step back and think of the risk level if you combined your human and financial capital into one portfolio and ask yourself, “Is this an investment you would be willing to invest all your wealth in?”

What do you think?

Note: If you want to know more about this concept check out this book Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance.

Comments on this entry are closed.